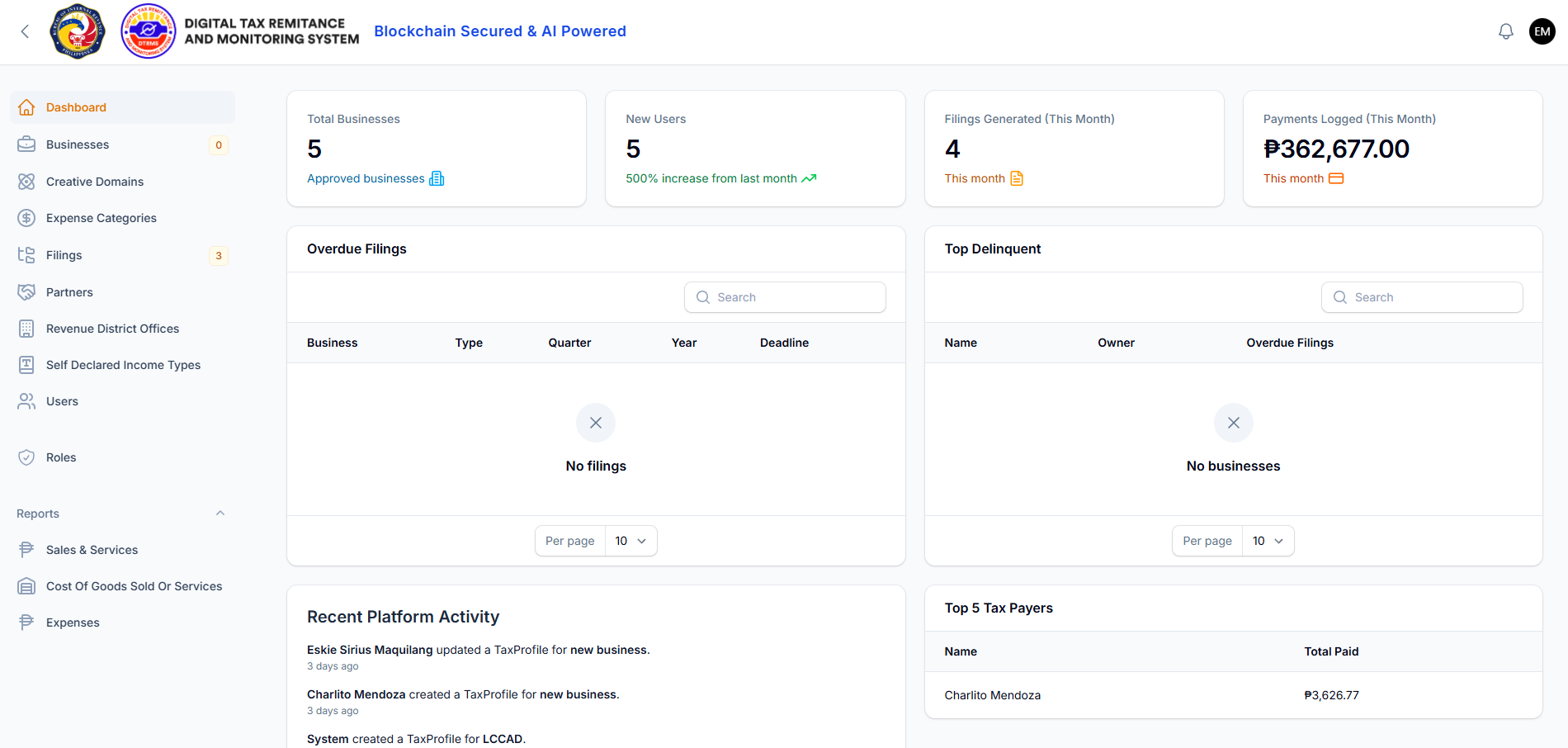

Simplify Digital VAT

Compliance

in the Philippines

Empowering Digital Service Providers with a seamless, BIR-compliant platform for registration, filing, and payment of Value Added Tax.

Bureau of Internal Revenue

Bureau of Internal Revenue

Leading the Way

Commissioner's Message

Supporting Digital Transformation

"Embracing digital solutions for a robust and fair tax system."